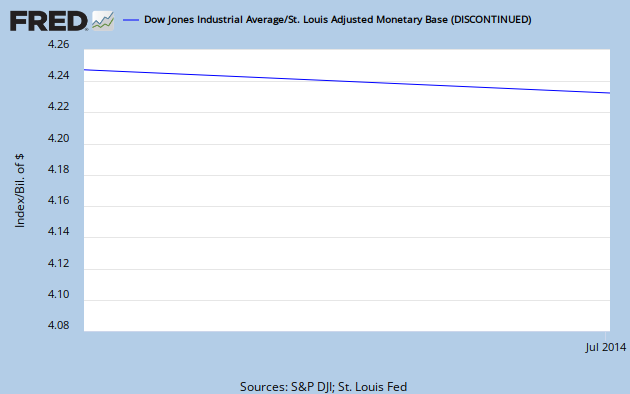

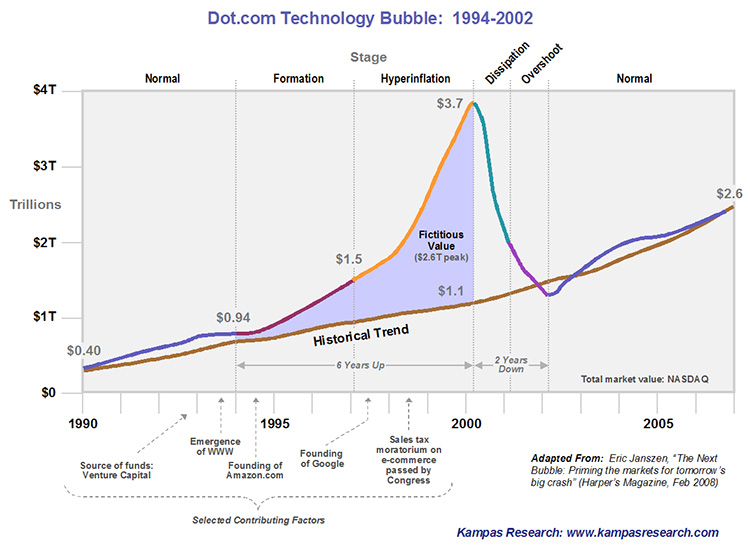

...or the stock value of the NASDAQ relative to the financial value of the technology companies represented on the exchange...

...or housing price escalation based upon amassing debt prior to the Great Recession.

Then look at the present value of fossil fuel reserves that sit as assets on the balance sheets of corporations and governments. If we reverse course and eliminate (or even significantly reduce) use of fossil fuels, we will drive down their price dramatically. This puts at risk $22-28 trillion in assets. To give you a sense of scale...the housing bubble was caused by a debt-fueled, inflated value of about $12 trillion in assets. This would be over twice times as much.

Enjoy the journey!

No comments:

Post a Comment